Why Supplement Merchant Accounts Get Shut Down (And How Underwriting Really Works)

Supplement merchant account shutdowns rarely happen “out of nowhere”—though most merchants operating in the supplement and nutraceutical industry report being blindsided when it happens. From the bank’s perspective, an account closure is usually the predictable result of underwriting risk, compliance gaps, or post-approval monitoring signals that the merchant never sees until the payment processor freezes funds.

Many supplement businesses only discover these underwriting realities after being approved by a processor that was never built to support their risk profile—which is why experienced high-risk merchant account brokers structure accounts differently from the start.

This guide is not a list of merchant services providers and not a “how to get a merchant account” checklist. It is an underwriting memo turned public—designed to explain why supplement and nutraceutical merchant accounts get shut down, how high-risk underwriting actually works, and what determines whether a business accepting credit cards can process payments long term.

Key Highlights

- Most supplement and nutraceutical merchant account shutdowns are driven by claims language, chargeback ratios, or post-approval monitoring—not legality alone.

- Underwriting evaluates the entire merchant operation: website, products, fulfillment, recurring billing, marketing language, and traffic sources.

- Mainstream payment processors like Stripe, Square, and PayPal rely on automated enforcement with zero tolerance for perceived high-risk activity.

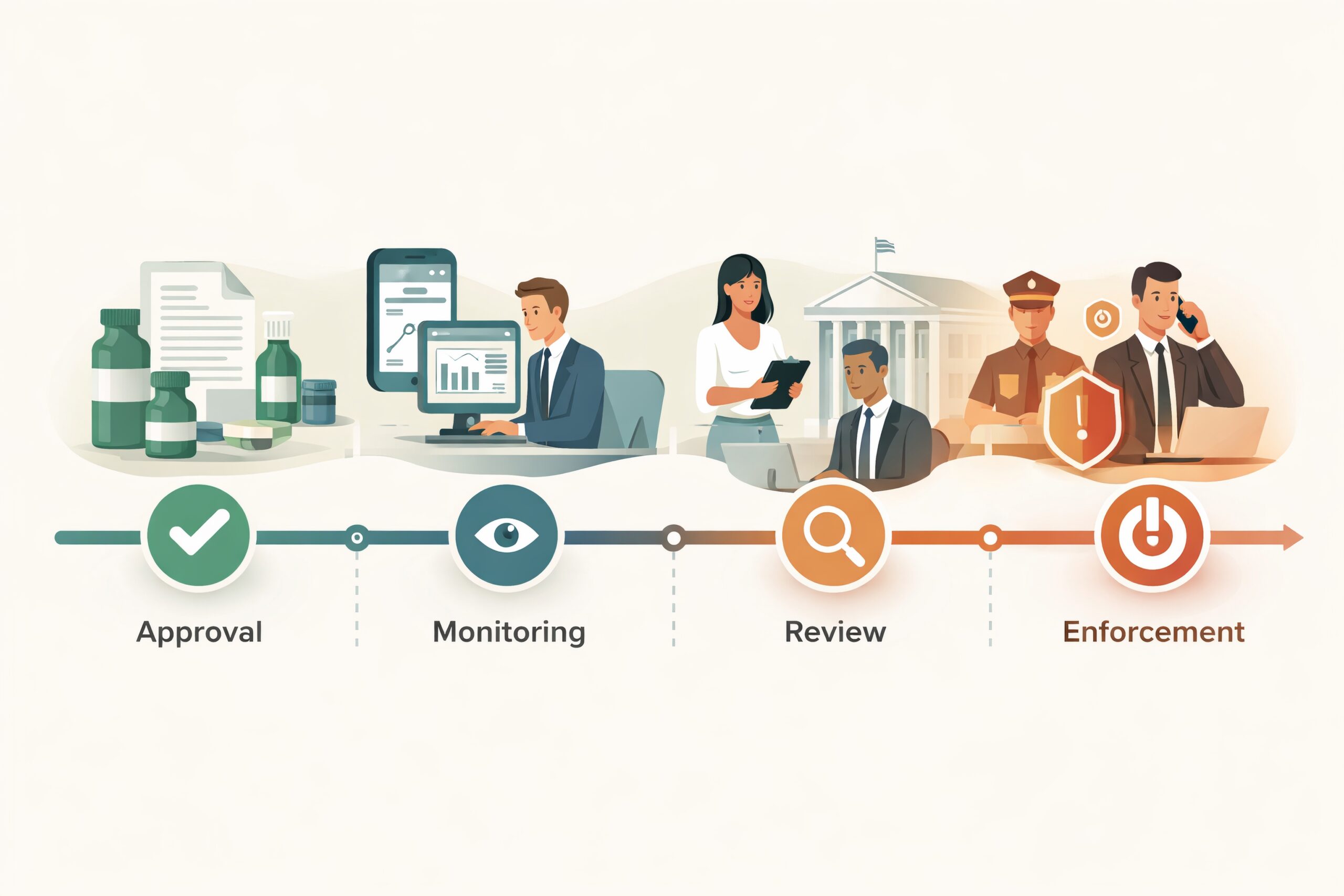

- An account being approved does not mean it is safe—rolling reviews and retroactive termination of your merchant account are standard in high-risk categories.

- Most shutdowns are not caused by illegal products, but by merchants being placed with banks that were never aligned with their risk profile.

Compatibility Beats Approval

In high-risk categories like supplements and nutraceuticals, approval is not the goal—compatibility is. A merchant account can be approved quickly and still be fundamentally unstable if the acquiring bank’s risk tolerance does not align with the merchant’s products, claims exposure, billing model, or traffic profile.

Underwriting failures rarely surface at onboarding. They emerge later, during monitoring, when the bank realizes the account behaves differently than the risk it agreed to support.

What Actually Triggers Supplement Merchant Account Shutdowns

Supplement and nutraceutical businesses are not shut down simply because they sell dietary supplements. Merchant accounts get shut when post-approval risk no longer aligns with what the acquiring bank agreed to underwrite.

Claims Language (The #1 Trigger)

Before-and-after claims, disease references, implied outcomes, or even vague performance promises (“supports rapid fat loss,” “clinically proven results”) are among the fastest ways to trigger a review. Banks and card networks treat claims risk as reputational risk—especially when tied to supplement sales. These restrictions align with FDA enforcement guidance on dietary supplement labeling and structure/function claims.

Subscription & Recurring Billing Risk

Recurring billing models increase transaction risk. Free trials, unclear rebill terms, or difficult cancellation flows frequently lead to a high chargeback rate, which payment processors monitor aggressively—especially in high-risk categories.

Chargeback Ratios

Sustained chargeback ratios above 1%—or even trending toward 0.75%—often trigger monitoring programs, rolling reserves, or termination of your merchant account. Exact thresholds vary by acquiring bank and program, but most supplement-focused banks begin heightened monitoring between 0.75%–0.9%. Every high risk merchant should consider chargeback alerts to keep your chargeback ratio low, at VERIFIED we offer discount Disputifier alerts.

Example: A nutraceutical business operating at a 0.6% chargeback ratio introduced a new free-trial funnel without updating billing descriptors. Within 45 days, the chargeback rate climbed to 1.2%, triggering a mandatory account review. Despite zero fraud, the merchant account was terminated two months later due to sustained dispute velocity the bank considered unmanageable.

Lesson: Never launch new billing models without processor notification and descriptor updates—even small funnel changes can trigger reviews.

Ingredient Flags

Certain ingredients attract enhanced scrutiny regardless of legality: weight loss compounds, testosterone precursors, nootropics, and sexual wellness botanicals. Underwriters evaluate concentration, marketing context, and prior network behavior—not just whether an ingredient is technically allowed.

Fulfillment Lag

Delayed shipping, backorders, or inconsistent tracking increase “non-receipt” chargebacks. From a card processing perspective, fulfillment reliability is a core indicator of merchant account risk.

What Processors Actually Look At During Underwriting

Underwriting for supplement and nutraceutical merchant accounts is holistic. Approval decisions go far beyond entity documents or credit score checks.

Website Crawl

Underwriters review product pages, blogs, FAQs, testimonials, footers, and metadata. Inconsistent or aggressive language across pages is one of the most common reasons a merchant account gets shut later.

Product Pages

Each dietary supplement SKU is evaluated individually. Claims framing, disclaimers, ingredient transparency, and dosage language all affect payment processing risk.

Policies

Refund, shipping, privacy, and contact policies must be clear and accessible. Weak policies are interpreted as future dispute and account freeze risk.

Marketing Language

Advertorials, email funnels, influencer scripts, and paid landing pages are frequently reviewed—even when hosted outside the primary website.

Traffic Sources

Traffic quality matters. Aggressive paid traffic, arbitrage funnels, or sudden volume spikes raise flags for payment processors evaluating high-risk merchant accounts.

Why Stripe, Square, and PayPal Fail Supplement Merchants

Mainstream payment processors like Stripe or Square are not built to manage nuanced high-risk underwriting.

Automation Over Human Review

Aggregators rely on automated systems to detect risk. Once a supplement merchant account is flagged, contextual human review is rare.

Zero-Tolerance Policies

If supplements fall outside acceptable use policies—even briefly—the account is closed rather than corrected. There is no gradual remediation path.

Post-Approval Monitoring

These platforms approve first and monitor later. Most automated merchant account shutdowns occur within 30–90 days post-approval.

Why “Approved Once” Doesn’t Mean You’re Safe

Most merchants assume approval equals compatibility—when in reality, many are boarded onto banks that were never aligned with their long-term risk profile.

Rolling Reviews

Banks continuously re-evaluate supplement and nutraceutical merchant accounts as volume, traffic mix, and product catalogs evolve.

Fund Holds

When an account is closed, funds are commonly held for 90–180 days to cover potential chargebacks.

How Real Brokers Mitigate Shutdown Risk

Reliable payment processing in the supplement industry is engineered. Approval is easy. Durable approval is engineered long before the first transaction.

Where VERIFIED Fits

VERIFIED Credit Card Processing operates as an underwriting-aware, multi-bank broker—not a single merchant account provider.

If you are building or scaling a supplement business, understanding underwriting mechanics is no longer optional. Before applying—or reapplying after a shutdown—consider working with an underwriting-aware broker who already knows which banks support your specific supplement category.

Frequently Asked Questions

Why do supplement merchant accounts get shut down after approval?

Are nutraceutical merchant accounts considered high-risk?

Why does Stripe shut down supplement merchant accounts?

Does removing claims guarantee merchant account safety?

How does a broker reduce supplement merchant account shutdown risk?

Why do supplement merchant accounts get shut down after approval?

Approval is provisional, not permanent. Payment processors continuously monitor supplement merchant accounts for changes in claims language, chargeback ratios, traffic sources, subscription activity, and fulfillment performance. When post-approval risk exceeds a bank’s tolerance, the account may be reviewed, restricted, or shut down.

Are nutraceutical merchant accounts considered high-risk?

Yes. Nutraceutical and supplement merchant accounts are classified as high-risk due to elevated chargeback exposure, marketing claims risk, recurring billing models, and increased regulatory scrutiny—even when products are legal and compliant.

Why does Stripe shut down supplement merchant accounts?

Stripe relies on automated enforcement and strict acceptable use policies. When supplements are detected or dispute thresholds are crossed, accounts are often closed without contextual human review. Stripe is designed for low-risk merchants, not ongoing supplement underwriting.

Does removing claims guarantee merchant account safety?

No. Claims language is only one factor. Even with compliant copy, supplement merchant accounts remain vulnerable if fulfillment is inconsistent, chargebacks exceed 0.75%, subscription cancellation flows are unclear, or traffic sources appear unstable.

How does a broker reduce supplement merchant account shutdown risk?

An underwriting-aware broker reduces shutdown risk by matching merchants to compatible acquiring banks, positioning risk correctly during underwriting, selecting appropriate gateways, and structuring accounts for durability rather than short-term approval.

Continue Reading

Let us discover your best options.

Either submit the form below or get in touch with an agent now (415) 835-4135.

Applying is risk-free; we send your details to underwriters to find the best fit and contact you with the best option or request more details, with no credit checks or commitments.