How to Reduce Supplement Business Chargebacks (A Complete Guide for Nutraceutical Merchants)

Key Highlights

- Chargebacks are a significant threat for supplement and nutraceutical merchants, especially those operating in high-risk categories.

- Most disputes can be prevented with better product clarity, subscription transparency, secure payment processing, and fast human support.

- Dispute prevention improves chargeback ratios, keeps a merchant account in good standing, and protects long-term processing.

- VERIFIED Credit Card Processing is a reseller of Disputifier, offering supplement merchants exclusive pricing lower than going direct for qualified processing customers.

- With the right workflow, supplement companies can reduce chargebacks, protect revenue, and grow their business with confidence.

Understanding supplement business chargebacks

A chargeback is a forced reversal of a credit card transaction after a customer disputes a purchase with their bank. In the supplement industry, chargebacks often stem from unclear expectations about results, recurring billing confusion, delivery delays, or preventable fraud. Because supplement companies are classified as high risk within the nutraceutical and supplement industry, even modest dispute spikes can push ratios to thresholds that concern banks and payment processors.

phrase triggers include unrealistic outcomes for a nutritional supplement, unrecognized autoship charges in online supplement sales, “product not received” claims, and marketing or labeling issues that create dissatisfaction. Addressing these triggers reduces chargeback rates and protects your merchant account from account closures.

Why nutraceutical merchants face high-risk chargeback exposure

- Subjective results: A dietary supplement can affect customers differently, which can lead to disputes and chargebacks when expectations aren’t set clearly.

- Continuity models: Online supplement businesses often rely on recurring billing; if cancellation isn’t simple, a dispute may be the customer’s path of least resistance.

- Fraud pressure: Low-ticket transactions invite card testing. Without fraud and chargebacks controls, legitimate revenue gets mixed with risky orders.

- Compliance: Within the nutraceutical industry, claims, labels, and disclosures are scrutinized; unclear information can increase risk for payment processors and escalate disputes.

The cost to your merchant account and payment processing

Each chargeback typically includes the sale reversal, product and shipping loss, and a fee per incident. Over time, high chargeback ratios lead to worse pricing, rolling reserves, or termination. Merchant accounts are considered a gateway to business growth for a business accepting credit cards; keeping ratios low preserves negotiating leverage and stable credit card processing solutions.

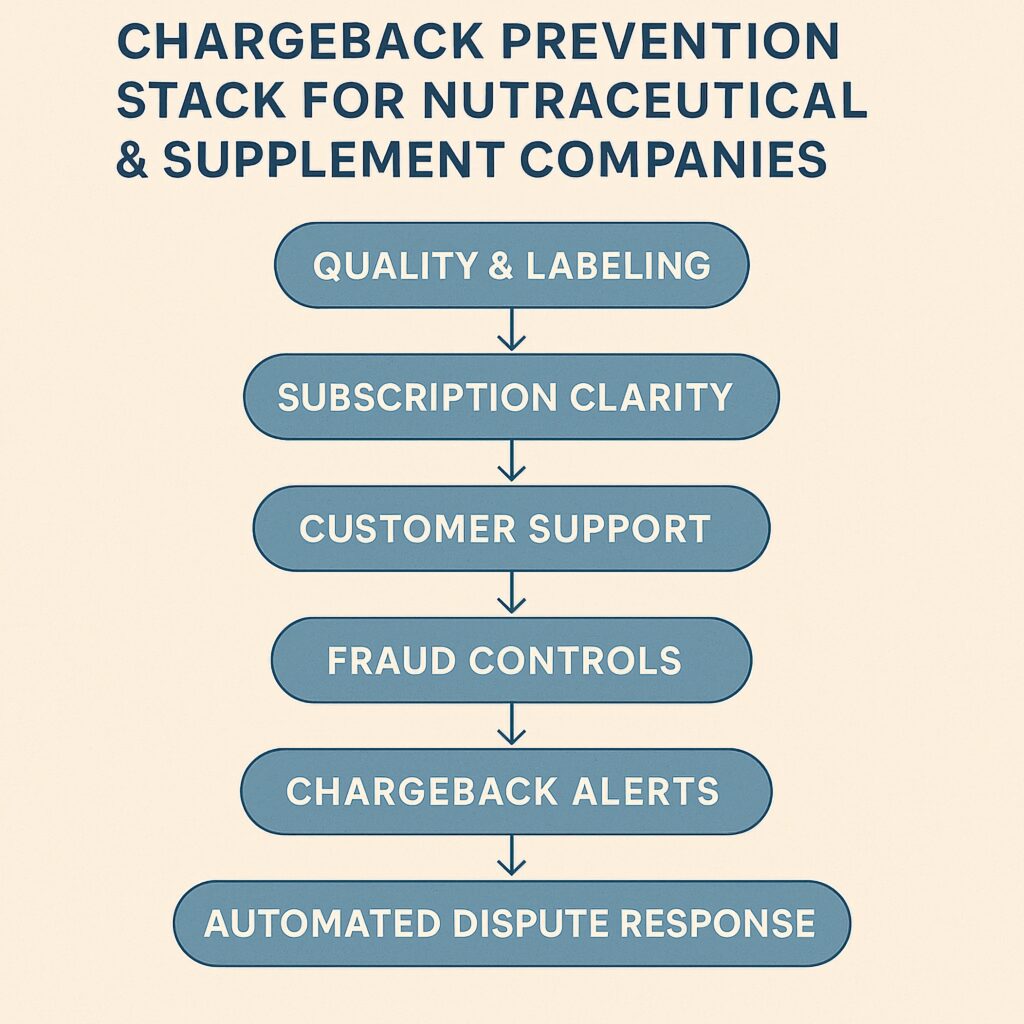

Prevention playbook for supplement and nutraceutical companies

1) Quality, labeling, and expectation setting

- Batch testing for potency and purity; align with GMP where applicable.

- Clear ingredient lists, allergens, and usage timelines for a nutritional supplement.

- Claims discipline; avoid exaggeration and set realistic results windows.

- On-page education for a supplement or nutraceutical about when benefits are typically noticed.

2) Subscription and billing clarity

- Pre-bill reminders 48–72 hours before rebills to reduce unrecognized charges.

- Visible terms at checkout with cadence, next bill date, and how to cancel.

- One-click cancel in the customer portal and in order emails.

3) Customer communication

- Respond within 12–24 hours; offer refund-first paths to prevent escalation.

- Send shipment tracking; proactively notify of delays or exceptions.

- Keep documentation: order records, tracking/POD, policy screenshots.

4) Secure payment processor, fraud controls, and payment gateway

- Choose a payment processor that specializes in high-risk payment categories and payment processing for nutraceutical merchants.

- Enable AVS, CVV, 3-D Secure, velocity filters, device fingerprinting, and BIN checks in your payment gateway.

- Set rules for mismatched AVS on first-time buyers and cap units on sensitive SKUs.

5) Refund-first policy

For ambiguous or frustration-based tickets, offering a quick refund is cheaper than absorbing a formal dispute. This single choice can materially reduce your chargeback ratio while improving customer sentiment.

Secure payment processor, payment gateway, and credit card processing checklist

- Right payment processor and high-risk payment processor experience with your business type.

- PCI-compliant encryption, tokenization, and secure payment flows.

- Card-network tools (3-D Secure) balanced with checkout UX to accept credit card payments efficiently.

- Rules to block obvious mismatches while allowing good transactions to proceed.

Chargeback management with Disputifier via VERIFIED

Alerts and early-warning programs (Ethoca, RDR, CDRN) can stop many disputes before they become chargebacks. Disputifier adds automation that saves time and improves outcomes:

- Automated evidence collection (order details, communications, delivery proof, policy snapshots).

- AI-generated responses formatted to card-network standards for credit card disputes.

- Analytics that surface risky SKUs, funnels, or traffic sources so you can adjust.

Through VERIFIED Credit Card Processing, supplement merchants access Disputifier at exclusive reseller pricing that is lower than direct for eligible processing customers. Combined with our merchant services, this creates a streamlined chargeback management workflow.

Compliance to keep your account in good standing

- Keep FDA/FTC-aware claims and labeling; file SOPs and supporting documentation.

- Show terms of sale, return/refund policy, and subscription terms above the purchase button.

- Capture timestamped consent for autoship, including IP, date, and time.

- Send receipts summarizing SKU, cadence, cancellation routes, and support contacts.

This documentation helps protect your merchant account and serves as evidence in disputes and chargebacks. It also reassures banks and payment processors that you are reducing risk proactively.

Merchant services and payment solutions tailored for high risk nutraceutical merchants

VERIFIED provides payment processing solutions for supplement and nutraceutical businesses, including a supplement merchant account or a nutraceutical merchant account as appropriate, secure payment options, and a dedicated account manager. If you are finding a payment processor or evaluating credit card processing solutions, we align underwriting to your offers and help you accept payments while reducing risk for payment processors.

As a merchant account provider and nutraceutical merchant account provider, we help supplement and nutraceutical companies avoid account closures, stabilize cash flow, and focus on growing your business.

FAQs for supplement merchant account and nutraceutical merchant account approval

\u003cstrong\u003eWhy are supplement and \u003ca href=\u0022https://verifiedcreditcardprocessing.com/top-5-supplement-payment-processing-solutions/\u0022\u003enutraceutical businesses treated\u003c/a\u003e as high risk?\u003c/strong\u003e

The high-risk nature of the supplement category includes subjective outcomes, recurring billing, compliance scrutiny, and fraud exposure. Many nutraceutical and supplement businesses operate online, which increases exposure to risky transactions.

\u003cstrong\u003eWhat should I look for when finding a payment processor?\u003c/strong\u003e

Seek a payment processor that specializes in high-risk categories, offers robust fraud tools, and supports payment processing for nutraceutical merchants. The right payment processor should provide a dedicated account and dedicated account manager, active monitoring, and practical policies that protect your business without blocking legitimate customers.

\u003cstrong\u003eHow do Disputifier and VERIFIED work together?\u003c/strong\u003e

VERIFIED is a reseller of Disputifier. Our supplement and nutraceutical merchants receive preferential pricing and integrated setup so alerts, evidence, and responses flow automatically. This helps reduce chargeback rates, maintain an account in good standing, and protect your merchant account.

\u003cstrong\u003eCan I accept credit card payments if I’ve had prior disputes?\u003c/strong\u003e

Yes. With the right underwriting and controls, a \u003ca href=\u0022https://verifiedcreditcardprocessing.com/understand-high-risk-merchant-accounts/\u0022\u003ehigh risk merchant account\u003c/a\u003e can be approved. Our team aligns processing solutions to your product mix and traffic sources so you can continue business accepting credit cards responsibly.

\u003cstrong\u003eDo you support nutraceutical credit card processing for different business types?\u003c/strong\u003e

We support online supplement businesses and other supplement and nutraceutical companies (including \u003ca href=\u0022https://verifiedcreditcardprocessing.com/glp-1-merchant-account-weight-loss/\u0022\u003eGLP-1\u003c/a\u003e) with tailored payment processing solutions, including payment processing for nutraceutical merchant needs and nutraceutical payment workflows.

Continue Reading

Let us discover your best options.

Either submit the form below or get in touch with an agent now (415) 835-4135.

Applying is risk-free; we send your details to underwriters to find the best fit and contact you with the best option or request more details, with no credit checks or commitments.