Comprehensive Guide to Nutraceutical Payment Processing Compliance and Supplement Merchant Accounts

Key Highlights

- Nutraceutical and supplement businesses are often labeled high-risk by banks and payment processors.

- Many traditional payment processors often decline nutraceutical merchants, making it hard to secure a merchant account.

- FDA and FTC rules require supplement companies to use accurate labels, disclaimers, and advertising that must adhere to compliance requirements.

- A nutraceutical payment processing solution includes PCI compliance, fraud tools, and chargeback prevention services.

- Partnering with a payment processor specializing in high-risk merchant accounts can streamline merchant processing and protect your business.

Understanding Nutraceutical Payment Processing

If you run a nutraceutical business, you already know that payment processing isn’t as simple as it sounds. The supplement industry is often flagged as high-risk, which makes securing a nutraceutical merchant account more difficult. Businesses in the nutraceutical and supplement industry (including GLP-1) must adhere to complex compliance requirements and manage higher-than-average chargebacks. This guide to payment processing is designed to simplify the process and give supplement companies clear steps toward compliant payment processing and stable accounts.

Why Nutraceutical Businesses Are Seen as High-Risk

Payment processors often classify nutraceutical or supplement companies as high-risk because of chargebacks, subscription billing issues, and regulatory oversight. Dietary supplements are closely monitored by the FDA and FTC. The nutraceutical industry is often grouped with CBD, kratom, and other high-risk categories. Supplement companies are classified this way because they face unique needs and challenges, including fraud, recurring billing complaints, and scrutiny over advertising claims. Many nutraceutical merchants find that a merchant account can be challenging to keep active without specialized support.

Nutraceutical and Supplement Compliance Requirements

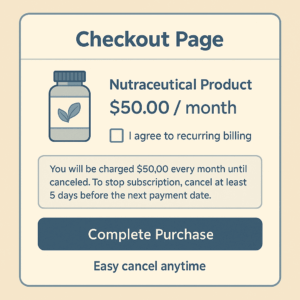

The FDA’s Dietary Supplement Health and Education Act outlines that dietary supplements must have proper labels, ingredient lists, serving sizes, and disclaimers. Herbal supplements are derived from natural plants, but even supplements are derived from plants must follow strict rules. The FTC requires that claims about health supplements be truthful and backed by real evidence. To ensure compliance, nutraceutical businesses must adhere to these rules in advertising, packaging, and customer communication. Clear subscription terms, easy cancellation, and transparent billing are also required for compliant payment processing.

Merchant Services and Documentation for Approval

When applying for a nutraceutical merchant account, providers will request documents like business licenses, financial statements, product labels, ingredient lists, and refund policies. Merchant processing requires transparency. Banks and payment processors want to see that your nutraceutical business can manage compliance requirements and keep disputes low. Many nutraceutical merchants find success when working with nutraceutical-focused processing partners who offer specialized payment processing solutions and understand the unique needs of nutraceutical companies. High risk merchant account providers are often the best payment choice because they know the challenges faced by nutraceutical businesses.

Nutraceutical Products and Payment Processing Solutions

Nutraceutical products range from sports nutrition to weight loss supplements and herbal blends. Each category has its own risks, but all require secure payment. A nutraceutical credit card processing setup should include PCI compliance, encryption, and fraud prevention tools. Every transaction must follow payment card industry data security standards. Offering various payment methods and online payment options makes checkout easier and builds customer trust. Payment providers that deliver specialized payment processing solutions can reduce the complexities of payment and improve approval chances for nutraceutical merchants.

Working with the Right Payment Processor

Finding the right payment processor is key to keeping your business stable. Many traditional payment processors often decline nutraceutical companies, but high-risk merchant account providers focus on this industry. When finding the right payment processor, look for features like chargeback prevention, PCI compliance support, and reliable merchant services. Partnering with a payment processor that understands nutraceutical or supplement merchants helps ensure compliance and lowers risk. Partner with a payment provider that can handle recurring billing, fraud prevention, and the demand for nutraceutical products.

How to Secure a Nutraceutical Merchant Account

To secure a nutraceutical merchant account, you must prepare for underwriting. Providers will review your documentation, subscription flows, and transaction history. Banks and payment partners want proof that you can manage risk and stay compliant. A merchant account can be challenging to obtain, but working with nutraceutical account providers who specialize in this sector makes the process easier. Partnering with a payment processor specializing in nutraceutical payment processing solutions ensures compliant payment processing and access to the best payment support for your business.

Checklist for Nutraceutical Payment Compliance

- Use FDA disclaimers and avoid unproven health or disease-treatment claims

- Ensure compliance with FTC advertising rules—claims must be backed by evidence

- Maintain refund, return, and subscription policies in plain view

- Implement PCI compliance standards with secure payment gateways

- Keep transaction records, ingredient lists, and supplier certifications on file

- Enable fraud tools such as AVS, CVV, and 3-D Secure for all online payment orders

- Monitor chargeback ratios and respond quickly to disputes

- Train customer service staff to resolve issues quickly and professionally

Conclusion: The Right Nutraceutical Partner

Nutraceutical businesses face strict compliance requirements and higher risk than many industries. Businesses in the nutraceutical industry must adhere to FDA and FTC rules, maintain PCI compliance, and work with experienced processing partners. By choosing VERIFIED Credit Card Processing, you gain access to specialized payment processing solutions that fit the unique needs of nutraceutical merchants. We help you secure a nutraceutical merchant account, provide chargeback protection, and deliver reliable payment acceptance. With the right nutraceutical payment processing solution, you can sell nutraceuticals confidently and grow your supplement business with long-term stability.

FAQs: Nutraceutical Payment Processing

Why are nutraceutical businesses considered high-risk?

Because the supplement industry has higher \u003ca href=\u0022https://verifiedcreditcardprocessing.com/disputifier-chargeback-management/\u0022\u003echargeback rates\u003c/a\u003e, strict regulations, and frequent advertising scrutiny. Many traditional payment processors often avoid these businesses, which is why high risk merchant account providers are recommended.

What documents do I need to apply for a nutraceutical merchant account?

You will need business licenses, financial statements, product labels, ingredient lists, and refund policies. Providers also review transaction history and subscription practices to ensure compliance.

Can I sell nutraceuticals using PayPal or Stripe?

Many traditional payment processors often decline nutraceutical merchants. Accounts may be shut down once supplements are detected. Specialized processing partners are safer for long-term merchant processing.

What is the best payment option for nutraceutical companies?

The best payment approach is to work with specialized payment providers that \u003ca href=\u0022https://verifiedcreditcardprocessing.com/understanding-payment-gateways/\u0022\u003eoffer secure payment gateways\u003c/a\u003e, PCI compliance, and fraud controls. This reduces risk and ensures smoother merchant processing.

How can I lower chargebacks in my supplement business?

Be clear with product descriptions, shipping timelines, and billing terms. Offer easy refunds, enable fraud filters, and use chargeback alerts. These steps help keep transaction disputes under control and protect your merchant account.

Continue Reading

Let us discover your best options.

Either submit the form below or get in touch with an agent now (415) 835-4135.

Applying is risk-free; we send your details to underwriters to find the best fit and contact you with the best option or request more details, with no credit checks or commitments.