A kratom merchant account shut down doesn’t just stop sales — it can trap working capital inside a 90–180 day hold window while you scramble to restore checkout. If you’ve received a termination notice (or your kratom payment processor closed account access overnight), the clock is ticking to secure your data, stabilize customer support, and rebuild a compliant path to credit card processing that won’t collapse again.

Last Updated: February 2026

TL;DR: Kratom merchant accounts are typically terminated during post-approval monitoring because sponsor banks detect rising disputes, compliance drift (GEO/age controls), undisclosed extract products (especially 7-OH), risky claims language, or sudden volume spikes. Preventing repeat shutdowns requires bank-program compatibility, strong operational controls, chargeback alert infrastructure, and high-risk merchant account architecture designed specifically for the kratom industry.

Quick Answer: A kratom merchant account is most often shut down due to rising chargeback ratios, compliance failures such as improper GEO blocking, undisclosed extract products (especially 7-OH), aggressive or medical claims language, or sudden volume spikes. Most shutdowns occur during post-approval monitoring — not during initial underwriting approval.

Key Highlights

- Most kratom account terminations are driven by compliance and chargeback monitoring — not federal illegality.

- Mainstream payment processors rely on automated enforcement and frequently close kratom accounts retroactively.

- Sustained chargeback ratios above 1% can trigger monitoring programs, reserves, or termination under card brand frameworks like Visa’s VAMP (Visa Acquirer Monitoring Program).

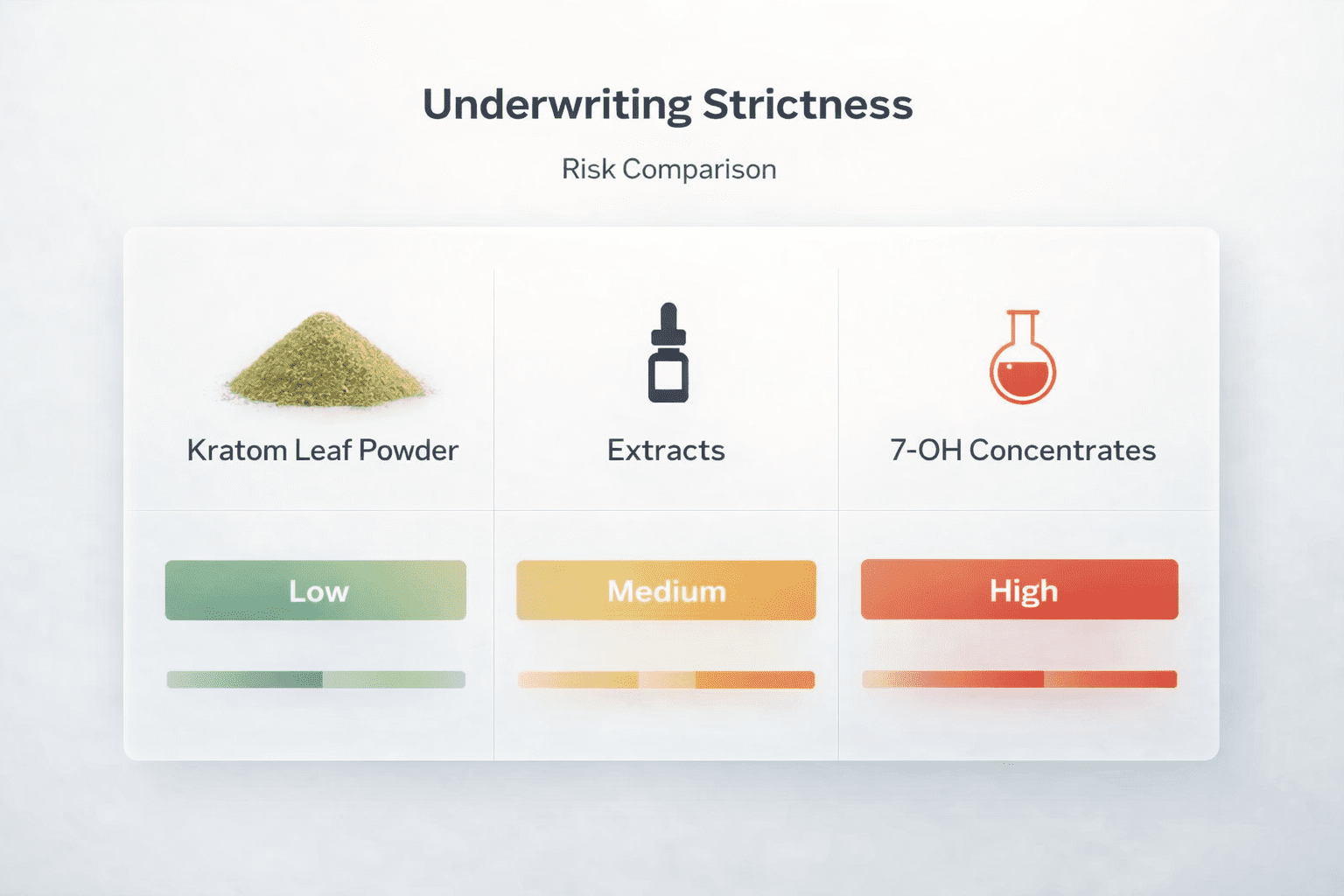

- Types of kratom products matter: powder, capsules, extracts, and 7-OH are not underwritten the same.

- Reliable kratom payment processing requires correct bank matching, strong policies, GEO controls, and dispute prevention architecture.

Direct Answer: Why Do Kratom Merchant Accounts Get Shut Down?

A kratom merchant account shut down occurs when a payment processor or acquiring bank terminates a merchant’s ability to accept cards because the account no longer fits the bank’s risk tolerance.

Approval is easy. Stability requires architecture.

Many shutdowns occur 30–120 days after onboarding — during monitoring reviews, not initial underwriting.

What Just Happened? Understanding a Kratom Account Terminated Notice

When your kratom account is terminated, the most common triggers include:

- Chargeback ratio crossing internal monitoring thresholds.

- Website re-scan flagging claims or new kratom product listings.

- Policy change at the sponsor bank.

- Undisclosed extract or 7-OH product expansion.

- Sudden volume spike inconsistent with underwriting projections.

Funds are often held 90–180 days to offset potential future chargebacks. Under Visa’s Acquirer Monitoring Program (VAMP), merchants exceeding combined dispute and fraud thresholds face escalating intervention from acquirers — from early warning letters to mandatory reserves or processing termination. (Learn more about VAMP thresholds)

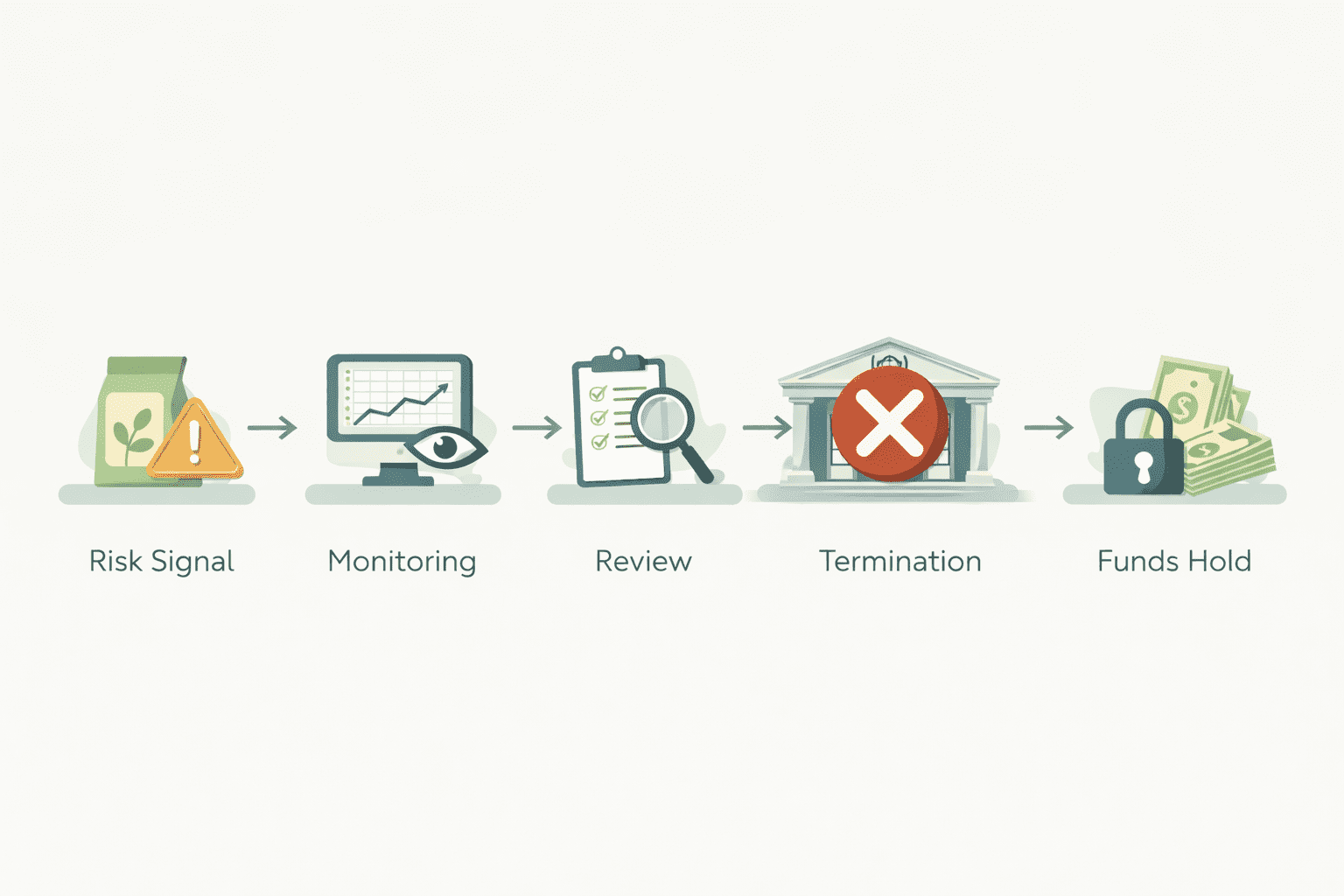

What a Typical Kratom Shutdown Timeline Looks Like

- Risk signal detected — dispute velocity, fraud spikes, or product mix change.

- Monitoring triggered — internal systems flag the merchant account.

- Site & SKU review — underwriters evaluate kratom products, gateway setup, and compliance.

- Termination decision — processing privileges are revoked.

- Funds hold applied — 90–180 day reserve window begins.

- Reserve offset — held funds applied to disputes before release.

Most merchants only see Step 4. The underwriting process started earlier.

Underwriting Perspective: Kratom Processing Termination Reasons Banks Actually Use

1. Chargeback Velocity

Sustained chargebacks above 1% often trigger monitoring programs. Under Visa’s VAMP framework (updated 2025), combined dispute and fraud ratios between 0.5% and 2.2% place merchants into escalating risk categories — with intervention ranging from early warning letters to mandatory reserves and potential termination.

Trending from 0.6% to 0.9% in a short period can initiate review even before crossing 1%.

Dispute trajectory matters more than a single month spike.

2. Product Mix Drift (Powder vs. Extracts vs. 7-OH)

Plain kratom leaf powder and capsules are underwritten differently than concentrated extracts. 7-Hydroxymitragynine (7-OH) products face tighter scrutiny across high-risk kratom merchant programs.

3. Claims Language Risk

Medical claims, disease references, or implied outcomes create reputational exposure for banks supporting the sale of kratom.

4. GEO Compliance Failures

Shipping to restricted states signals weak controls. As of February 2026, six U.S. states maintain statewide kratom bans: Alabama, Arkansas, Indiana, Rhode Island, Vermont, and Wisconsin. Additional municipalities within otherwise-legal states also prohibit kratom sales, requiring ZIP-level blocking rather than state-only filters.

“We don’t market there” is not the same as “our cart blocks checkout there.” Underwriting teams care about the cart.

5. Volume & Traffic Spikes

Rapid revenue growth or new traffic sources can trigger fraud modeling reviews — especially in high-risk payment categories like kratom processing.

The 7-OH Compliance Gap

In the current underwriting landscape, 7-OH products represent one of the most common escalation triggers. Even when a bank supports kratom generally, it may not support concentrated alkaloid positioning without separate underwriting.

Introducing 7-OH without disclosure is a leading cause of merchant account termination in the kratom industry.

The MATCH / TMF Risk Most Merchants Don’t Understand

A shutdown is disruptive. A MATCH (Member Alert to Control High-Risk Merchants) listing can make securing future merchant accounts significantly more difficult. Merchants reduce MATCH exposure by documenting termination reasons clearly, reducing post-closure dispute velocity, and reapplying with proper high-risk merchant account placement instead of mainstream aggregators.

What To Do In The First 72 Hours After a Kratom Shutdown

The first 72 hours after a kratom merchant account termination are critical. Decisions made during this window can either stabilize your position — or make future underwriting significantly harder.

- Contact your processor immediately — Request written confirmation of the termination reason. Document everything.

- Review your billing descriptor — Ensure it matches how customers recognize your kratom business. Descriptor confusion drives post-closure disputes.

- Check dispute velocity — Pull your last 90 days of ratios. Identify whether you were trending upward before termination.

- Preserve processing history — Download statements, gateway reports, and fulfillment proof before access is revoked.

- Do NOT reapply randomly — Multiple rapid applications create additional underwriting red flags.

- Secure backup routing — If possible, establish a secondary high-risk kratom processing path before relaunching paid traffic.

Rushed applications compound risk. Structured recovery reduces repeat shutdown probability.

Mainstream Processors vs. High-Risk Kratom Payment Processing Solutions

| Factor | Mainstream Aggregators | High-Risk Kratom Specialists |

|---|---|---|

| Category Support | Often reject kratom merchants | Programs structured to support kratom businesses |

| Monitoring Style | Automated enforcement | Human underwriting review |

| Funds Holds | Common after account closure | Structured reserve-based risk management |

| Redundancy | No backup processing path | Multi-bank optionality for processing stability |

How to Prevent Another Kratom Merchant Account Shut Down

1. Monitor Disputes Weekly

Track trends before they cross 0.75%. Underwriting teams care about direction, not just the current number.

2. Use Chargeback Alerts and Deflection

Chargeback alerts are real-time notifications from card networks or alert providers that notify a merchant when a cardholder initiates a dispute — before it formally becomes a chargeback.

When configured properly, alerts allow kratom merchants to issue a refund immediately, preventing the dispute from entering the formal chargeback system and protecting their ratio under programs like Visa’s VAMP.

For high-risk categories like kratom, alert coverage can be the difference between operating at 0.7% and crossing 1% — which is often the line between monitoring and termination.

Not all processors offer integrated alert tools. VERIFIED structures kratom merchant accounts with gateway partners that support dispute alert networks and rapid refund workflows, helping stabilize payment processing before ratios trigger escalation.

3. Maintain ZIP-Level GEO Blocking

Block restricted ZIP codes automatically and log declined attempts. Good logs are underwriting proof that your kratom business account is controlled.

4. Stage High-Risk SKUs Carefully

Introduce extracts and 7-OH products only after stable processing history is established and proper disclosure is made to your acquiring bank.

Durable approval is engineered.

Where VERIFIED Fits

VERIFIED Credit Card Processing operates as an underwriting-aware broker specializing in high-risk merchant accounts for industries like kratom.

We match kratom merchants to compatible acquiring banks based on product mix, dispute history, and operational controls — and structure redundancy so a single processor change does not end processing.

If you are experiencing a shutdown, review your kratom merchant account structure first. Our kratom payment processing guide explains long-term architecture, and the kratom payment compliance checklist outlines preventive controls.

Approval is easy. Stable payment processing is engineered.

Frequently Asked Questions

Why did my kratom merchant account get shut down without warning?

Most kratom merchant accounts are shut down during post-approval monitoring when dispute thresholds, product mix drift, or compliance gaps exceed a sponsor bank’s tolerance.

How long are funds held after kratom account termination?

Funds are commonly held 90–180 days to offset potential future chargebacks, especially when dispute velocity remains elevated.

Can I get approved again after a kratom shutdown?

Yes, but reapproval requires correcting the original trigger and securing placement with a compatible high-risk merchant account program.

Continue Reading

Let us discover your best options.

Either submit the form below or get in touch with an agent now (415) 835-4135.

Applying is risk-free; we send your details to underwriters to find the best fit and contact you with the best option or request more details, with no credit checks or commitments.