Written by VERIFIED Credit Card Processing | High-Risk Payments Specialist

Last Updated: February 2026

- Kratom chargeback ratios above ~0.75% typically trigger heightened underwriting review.

- Sustained ratios near or above 1% materially increase monitoring program and termination risk.

- Most kratom chargebacks stem from operational friction — shipping delays, subscription errors, and billing descriptor confusion.

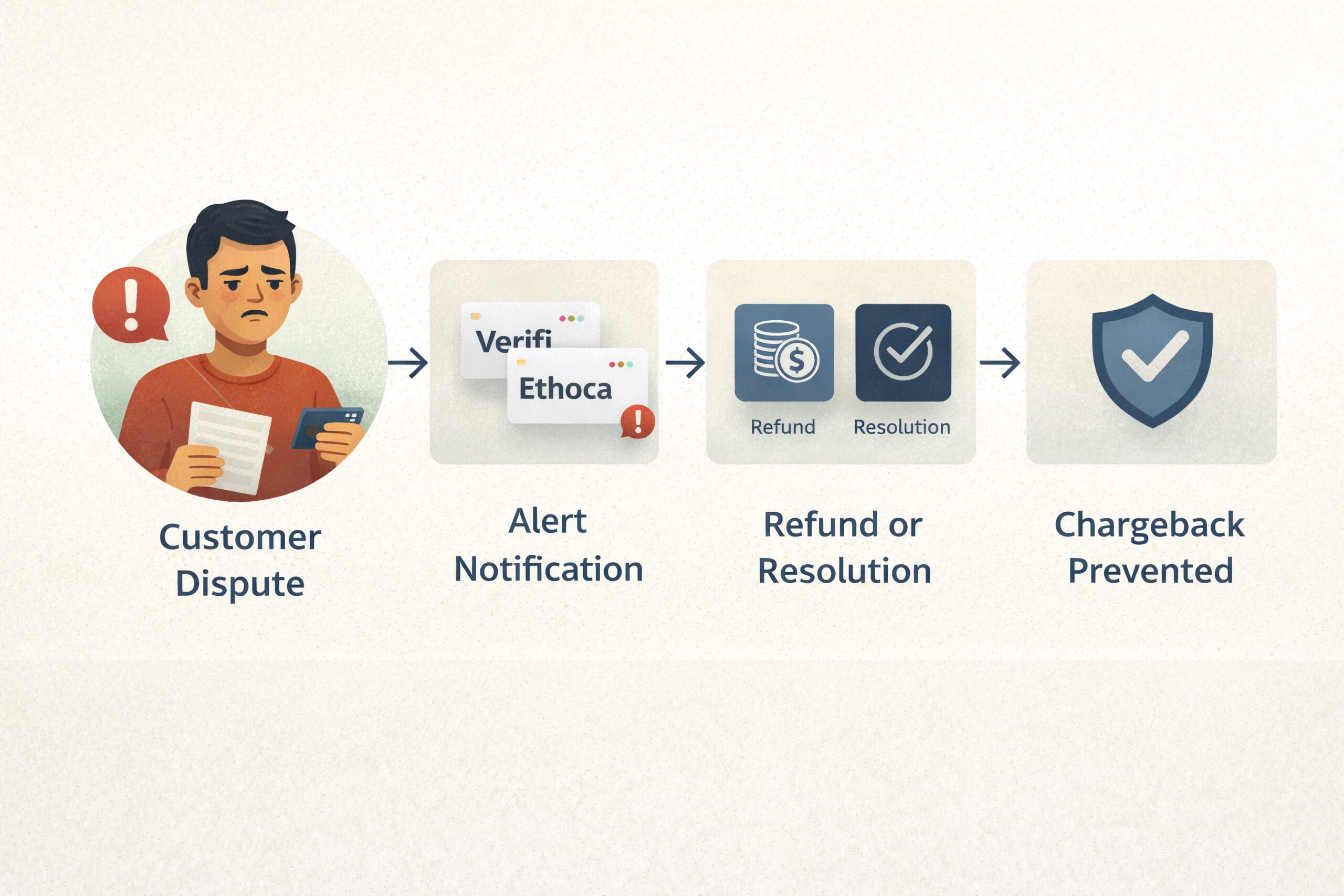

- Verifi (Visa) and Ethoca (Mastercard) alerts can deflect disputes before they become posted chargebacks.

Kratom merchants should keep chargeback ratios below ~0.75–1% to reduce monitoring and termination risk. This guide explains how kratom chargebacks are calculated, what thresholds matter, and how to prevent disputes before they post.

Kratom chargebacks are one of the fastest ways a kratom merchant account moves from stable processing to underwriting concern. In kratom payment processing, banks monitor dispute velocity because it predicts future financial exposure. When ratios rise, the response is usually financial and immediate: reserve increases, funding delays, reclassification pressure, or account termination.

Chargebacks are operational. Underwriting responses are financial.

Why Kratom Merchants Face Higher Chargeback Risk

Kratom is widely categorized as high-risk by many banks and payment processors due to regulatory scrutiny and fragmented state-level legality. Federal agencies have issued public health communications and import-related actions concerning kratom products. (FDA Import Alert 54-15; FDA and Kratom)

State-level legality varies, adding operational complexity for kratom merchants shipping nationwide. (CRS: Kratom Regulation)

Industry self-regulation also plays a role. The American Kratom Association (AKA) maintains voluntary GMP standards adopted by compliant kratom businesses. (AKA GMP Standards Program)

However, most kratom chargebacks are caused by operational friction — not regulation.

For shutdown scenarios and recovery strategy, review: kratom merchant account shut down.

What Are Kratom Chargebacks?

A kratom chargeback occurs when a customer disputes a credit card transaction through their issuing bank instead of requesting a refund directly from the merchant.

Dispute vs. chargeback: A dispute begins when the cardholder contacts their bank. A chargeback is the formal network-level reversal that posts to your merchant account if the dispute proceeds.

Card networks publish structured monitoring frameworks outlining how disputes and chargebacks trigger review. (Visa Dispute Monitoring Program; Mastercard Chargeback Guide)

How Chargeback Ratios Are Calculated

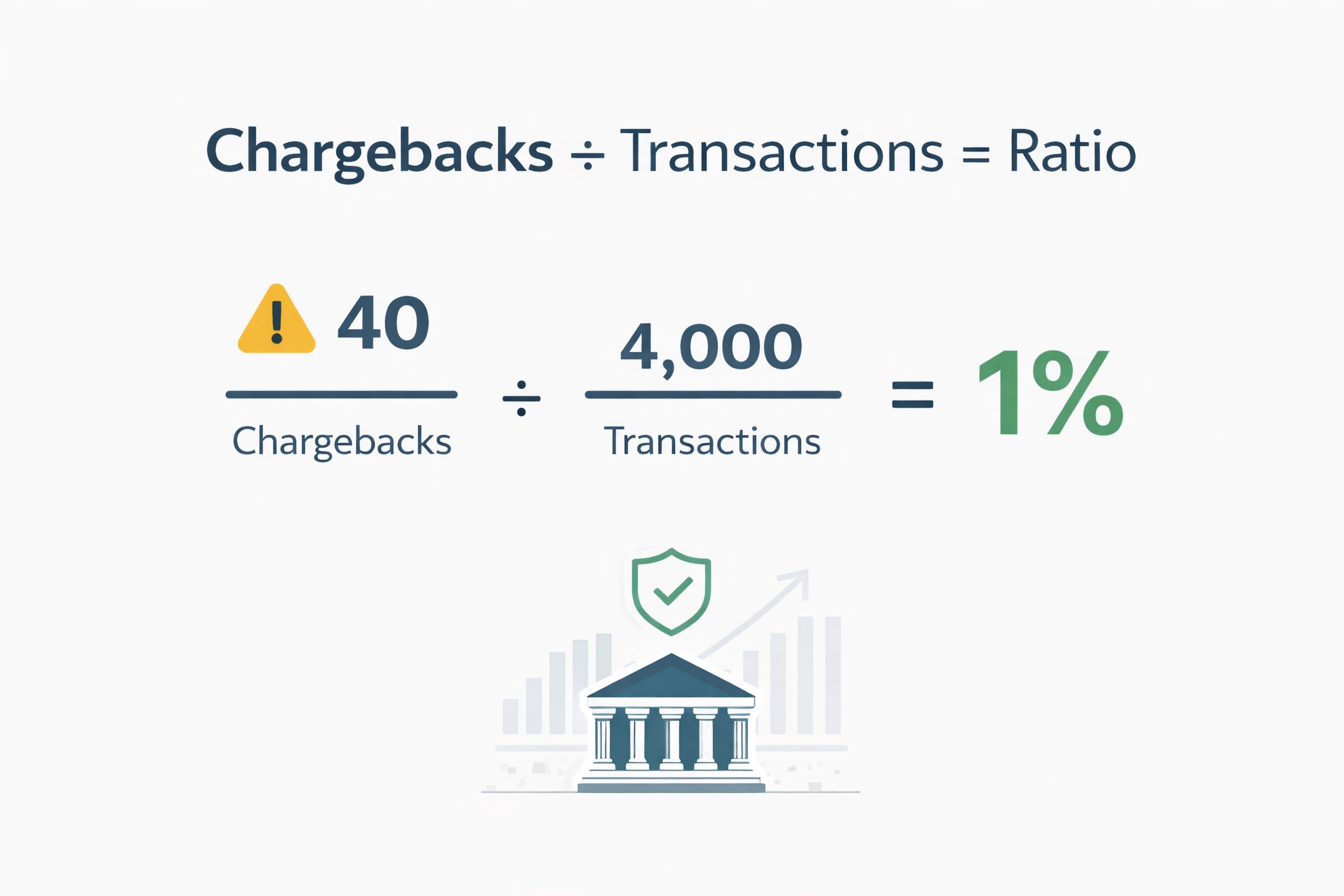

Chargebacks in period ÷ Transactions in period = Chargeback Ratio

Example: 40 chargebacks ÷ 4,000 transactions = 1%.

Both the percentage and total dispute count are evaluated.

What Is an Acceptable Chargeback Ratio for Kratom?

Operationally, many underwriting teams intensify review near ~0.75% when trending upward. Sustained ratios at or above 1% significantly increase monitoring and termination risk.

| Chargeback Ratio | Underwriting Interpretation | Merchant Account Risk |

|---|---|---|

| 0.40% – 0.60% | Stable processing environment | Low |

| 0.70% – 0.90% | Heightened review / trend monitoring | Elevated |

| 1.00%+ | Program exposure likely (ratio + count dependent) | High |

For pricing implications, see: kratom merchant account fees.

The Most Common Kratom Chargeback Triggers

Shipping & Fulfillment Delays

Delayed fulfillment and weak tracking updates frequently convert into item-not-received disputes. Proactive communication reduces escalation.

Product Expectation Gaps

“Not as described” disputes often stem from unclear labeling or expectation mismatch, particularly with extracts or enhanced blends.

Subscription Billing Confusion

Second-cycle subscription billing is a consistent spike point in kratom merchant processing. Pre-bill reminders and simple cancellation significantly reduce friendly-fraud exposure.

Billing Descriptor Mismatch

If the billing descriptor does not clearly match the storefront brand — or lacks a reachable phone number — customers often dispute first and investigate later.

For structural guidance, review: kratom payment compliance.

Field Notes: What Reduces Chargebacks Fastest

Across kratom merchants reviewed, the fastest reductions typically come from operational clarity — descriptor alignment, proactive shipping communication, and subscription reminders.

In our experience, these operational fixes often reduce dispute volume within 30 to 60 days, before any gateway-level fraud rule changes are required.

A 7-Step Kratom Chargeback Prevention Framework

- Age verification controls — Apply and document consistent age-gating to reduce avoidable disputes.

- Clear COA access — Make lab documentation obvious and accessible to prevent “not as described” claims.

- Transparent refund policy — Refunds cost less than chargebacks and reduce bank escalation.

- Shipping communication automation — Proactive tracking and fast support reduce INR disputes.

- Descriptor optimization — Match storefront branding and include a reachable support number.

- Dispute alert enrollment — Implement Verifi/RDR and Ethoca workflows to deflect disputes early.

- Backup payment routing — Maintain redundancy to protect revenue if underwriting terms shift.

Modern standards note: Apply EMV 3-D Secure (3DS 2.x) where appropriate and maintain gateway-level velocity controls for abnormal purchase detection. (EMVCo: 3-D Secure)

Should Kratom Merchants Use Chargeback Alert Services?

Yes — when paired with a defined response workflow. Alerts are effective only if refunds or resolutions are issued quickly enough to prevent formal chargebacks.

Verifi (Visa) vs. Ethoca (Mastercard)

Visa disputes commonly route through Verifi tools such as Rapid Dispute Resolution (RDR). (Verifi RDR)

Mastercard alerts are typically delivered through Ethoca. (Ethoca)

Merchants working with VERIFIED partners can often access discounted alert and structured chargeback management solutions. For operational detail, see: Disputifier chargeback management.

What Happens If Ratios Exceed 1%?

- Monitoring program exposure

- Rolling reserve increases

- Funding delays

- Account termination risk

- Reclassification pressure

This isn’t just a kratom issue. The Merchant Risk Council documents rising dispute and friendly-fraud pressure across ecommerce categories, which is why network and acquirer tolerance has tightened industry-wide. (MRC 2025 Global eCommerce Payments & Fraud Report)

Once terminated, re-boarding is possible but typically requires documented remediation, stronger operational controls, and more conservative reserve terms.

If ratios are already elevated, read before reapplying: kratom merchant account shut down.

Next Steps

- Calculate your 90-day chargeback trend immediately.

- Fix descriptor and subscription friction first.

- Enroll in alert tools before ratios escalate.

- Stabilize your profile before applying elsewhere.

Before submitting new applications, review: kratom merchant account.

Frequently Asked Questions

What is a high chargeback ratio for a kratom merchant account?

A high chargeback ratio for a kratom merchant account is typically around 1% or higher when ratio and count thresholds are met. Many acquiring banks intensify review near ~0.75% when dispute velocity is rising.

How do I lower kratom chargebacks quickly?

To lower kratom chargebacks quickly, align your billing descriptor with your storefront brand, shorten refund response times, add subscription reminders, and improve proactive shipping communication.

Do Visa and Mastercard use the same dispute alert system?

No. Visa disputes commonly route through Verifi tools such as Rapid Dispute Resolution (RDR), while Mastercard alerts are typically delivered through Ethoca.

Does slow shipping cause kratom chargebacks?

Yes. Delayed shipping and weak tracking updates frequently convert into item-not-received disputes that escalate to chargebacks.

Can I get a kratom merchant account with past chargeback issues?

Yes, but approval usually requires documented remediation, stronger operational controls, and placement through specialized high-risk acquiring relationships.

Continue Reading

Let us discover your best options.

Either submit the form below or get in touch with an agent now (415) 835-4135.

Applying is risk-free; we send your details to underwriters to find the best fit and contact you with the best option or request more details, with no credit checks or commitments.