Supplement merchants rarely expect payment disruptions after an easy approval. Yet across Stripe, Shopify Payments, and PayPal, the pattern is consistent: fast onboarding, early growth, then a sudden freeze or termination. From an underwriting perspective, these shutdowns are not random. They are the predictable result of how aggregated platforms manage risk after approval—not how merchants operate in good faith. Whether you have already suffered a supplement payment processor shutdown or want to avoid one this article is for you.

Last Updated: February 2026

Supplement merchants get shut down by Stripe, Shopify Payments, and PayPal because these platforms approve merchants under aggregated accounts, then enforce risk retroactively when chargebacks, claims language, or volume patterns exceed what their sponsoring banks will tolerate.

Key Highlights

- Mainstream platforms approve supplement merchants quickly but enforce risk retroactively.

- Platform policy approval is not the same as acquiring bank underwriting acceptance.

- Most shutdowns occur after volume increases or monitoring thresholds are crossed.

- Aggregated payment models prioritize platform protection over merchant survivability.

- Dedicated, broker-placed merchant accounts are structured for durability, not speed.

Why This Keeps Happening to Supplement Merchants

Supplements are conditionally allowed on mainstream platforms. That conditional allowance is the source of most merchant confusion.

When Stripe, Shopify Payments, or PayPal approve a supplement business, the approval is based on platform-level acceptable use rules—not on a bank underwriting the merchant’s long-term risk. Merchants interpret approval as safety. Platforms interpret it as provisional access.

This disconnect explains why shutdowns feel sudden. Risk does not usually appear at onboarding. It appears later—once volume, billing behavior, or marketing activity reveals exposure the platform was never built to support.

For a deeper underwriting explanation, see Why Supplement Merchant Accounts Get Shut Down (And How Underwriting Really Works).

Stripe vs Shopify Payments vs PayPal: How They Compare for Supplements

| Platform | Account Model | Supplement Risk Tolerance | Shutdown Pattern |

|---|---|---|---|

| Stripe | Aggregated (PayFac) | Low to Moderate | Automated review after volume, claims, or disputes |

| Shopify Payments | Aggregated (Stripe-backed) | Low | Retroactive enforcement tied to site scans and disputes |

| PayPal | Aggregated wallet model | Low | Account limitation or freeze with extended fund holds |

How Stripe, Shopify Payments, and PayPal Actually Evaluate Risk

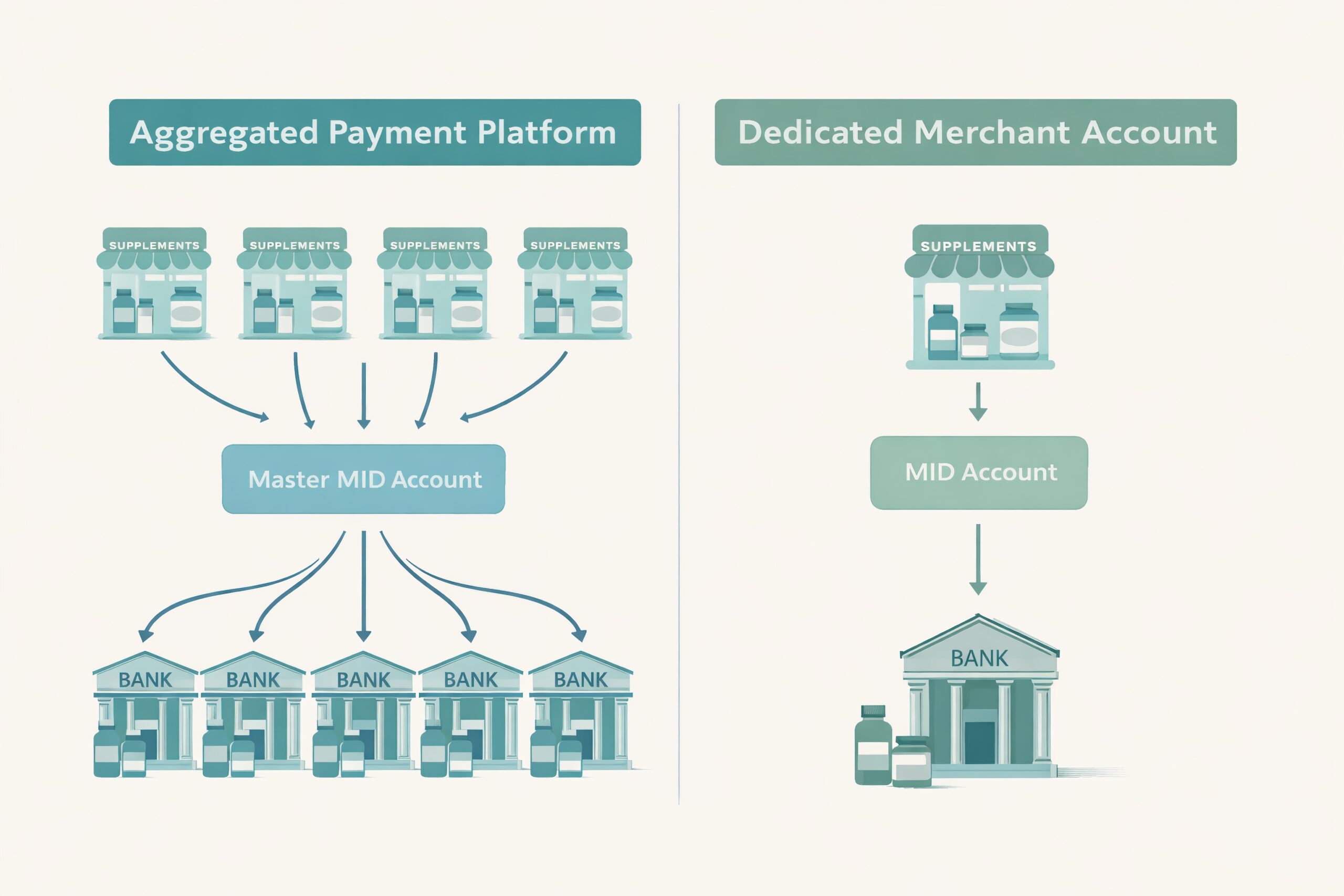

Mainstream platforms operate as aggregated payment facilitators. Multiple merchants share a master merchant account, and the platform—not the merchant—assumes liability to the acquiring bank.

An aggregated payment platform is a model where merchants are approved quickly under a master account, while risk is enforced continuously and retroactively to protect the platform—not the individual merchant.

Risk is scored automatically and re-evaluated continuously. Reviews are triggered by patterns, not intent. When thresholds are crossed, enforcement is immediate.

These platforms optimize for scale and consistency. Merchant survivability is secondary to maintaining predictable risk across millions of accounts.

This is why supplement merchants operating beyond early-stage volume are better served by dedicated high-risk merchant accounts rather than aggregation.

The Specific Triggers That Get Supplement Merchants Shut Down

Primary Triggers

- Claims language drift: Ads, testimonials, or landing pages evolve beyond what was initially reviewed.

- Chargeback velocity: Ratios approaching 0.75%–1% or upward trends over short periods (Visa monitoring programs begin at 0.75%). Mastercard chargeback programs use similar thresholds.

- Subscription continuity issues: Confusing rebills, free trials, or cancellation friction subject to FTC continuity rules.

Risk Accelerants

- Sudden paid traffic spikes.

- Ad platform enforcement feeding risk signals back to processors.

- Product or ingredient reclassification.

- MCC or billing descriptor mismatches.

“FDA compliant” does not equal bank-safe. Banks underwrite outcomes, not intent.

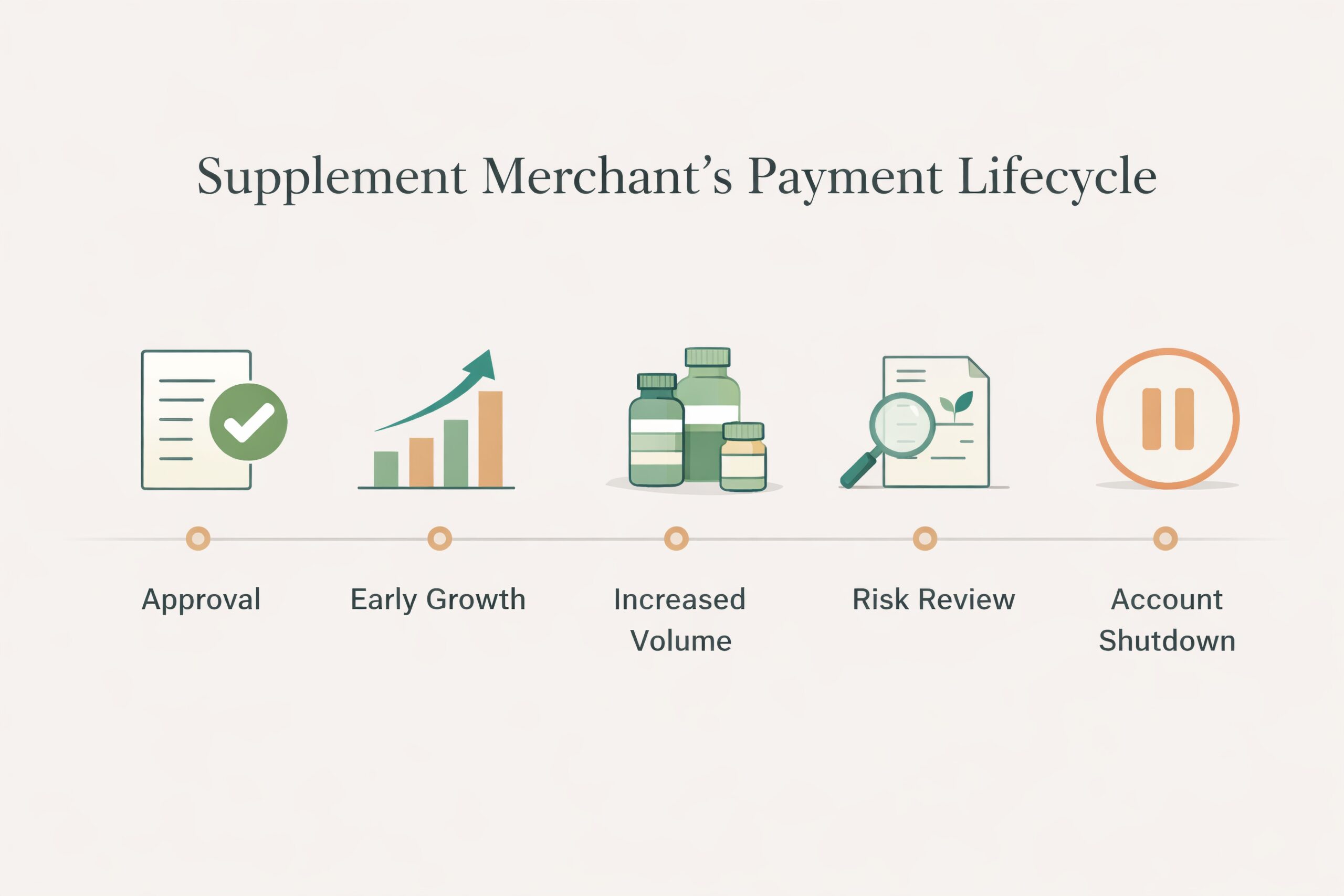

Typical Timeline of a Supplement Merchant Shutdown

- Month 0–1: Account approved, low volume, minimal scrutiny.

- Month 2–3: Volume increases, paid traffic launches, automated rescans begin.

- Month 3–4: Chargeback trend or claims drift triggers internal review.

- Month 4–6: Account frozen, funds held 90–180 days, appeals denied.

Case Study: How a “Clean” Supplement Brand Still Got Shut Down

A mid-seven-figure supplement brand launched on an aggregated platform with compliant labels and no prior processing issues.

- Month 1: $18k volume, zero disputes.

- Month 3: $65k volume after paid ads launched.

- Month 4: Chargebacks rose to 0.82% due to subscription confusion.

- Month 5: Automated review triggered by dispute velocity + ad claims drift.

- Outcome: Account terminated, $92k held for 120 days.

No fraud. No illegal products. Just structural mismatch.

Why Policy Compliance Is Not the Same as Bank Acceptability

Platforms approve policies. Banks underwrite outcomes.

Appeals rarely succeed because decisions are based on portfolio exposure, not merchant explanations.

If you want an underwriting-first review of your setup, a quiet consultation through VERIFIED Credit Card Processing can clarify whether your current structure is aligned or exposed.

What Happens After a Platform Shutdown

- Funds held 90–180 days.

- Gateway risk flags complicating re-onboarding.

- MATCH/TMF listings uncommon but possible in escalated cases.

How High-Risk Brokers Structure Supplement Accounts Differently

- Pre-underwriting before submission.

- Bank matching by product, traffic, and billing model.

- Gateway selection aligned with monitoring tolerance.

- Multi-bank optionality.

Approval is harder. Accounts last longer.

Chargeback “surprises” are what push many supplement accounts over the edge on aggregated platforms. Early-warning alerts help you see disputes fast, issue refunds strategically, and reduce dispute velocity before it triggers a review.

VERIFIED can also provide Disputifier partner discounts for eligible merchants — ask during your underwriting review: https://verifiedcreditcardprocessing.com/apply/

Who Should Not Use Stripe, Shopify Payments, or PayPal for Supplements

- Scaling brands using paid traffic.

- Subscription-based supplement models.

- Multi-SKU catalogs with evolving claims.

What to Do If Your Supplement Account Was Just Shut Down

- Do not apply blindly elsewhere.

- Preserve shutdown communications.

- Identify the trigger before reapplying.

Merchants facing shutdowns typically stabilize fastest by working with an experienced high-risk broker.

Frequently Asked Questions

Why do supplement merchants get shut down by Stripe?

Because Stripe operates as an aggregated platform and enforces bank risk retroactively when chargebacks, claims, or volume exceed tolerance.

Are all supplements considered high-risk?

No. Risk depends on ingredients, claims, billing model, and traffic sources, all of which banks underwrite holistically.

Can switching gateways prevent shutdowns?

No. Gateways do not control bank underwriting decisions.

Do chargebacks always cause termination?

Not immediately. Sustained velocity or upward trends trigger reviews that may lead to shutdown.

How can brokers reduce shutdown risk?

By matching merchants to compatible banks and structuring accounts for long-term stability.

Continue Reading

Let us discover your best options.

Either submit the form below or get in touch with an agent now (415) 835-4135.

Applying is risk-free; we send your details to underwriters to find the best fit and contact you with the best option or request more details, with no credit checks or commitments.